Myth 1 - "Tax Breaks for the Rich Create Jobs!"

As you can see, this graph is from the Bureau of Labor Statistics and Tax Policy Center, not some liberal spin machine or the "lamestream media". According to this graph, there is no historical data whatsoever to suggest that lower taxes on the rich results in more job growth. In fact, the years when job creation was the highest, the tax rate was between 69-80%. The 3rd highest year for job growth saw an upper class tax rate of 39.6%. It can be determined from this graph, however, that whenever upper class tax rates fell below 39%, job growth actually declined substantially. Based on this graph, the "sweet spot" for job growth vs. upper class tax rate is between 40-80%. Kind of makes that roll back to the Clinton era tax rate seem like a sweet deal, doesn't it? The bottom line, however, as this graph clearly shows, is that lowering taxes for the wealthiest Americans... the "job creators" doesn't, in fact, result in the creation of more jobs. Statistically speaking, it actually results in less job growth. Lower taxes on the rich means more jobs? Myth.

Myth 2 - "War is Good for the Economy!"

There are quite a few people, from politicians to historians to economists, who talk about how WW2 brought America out of the Great Depression. While the war was good for manufacturing and ultimately the economy at large, there are important things that must be recognized about not only WW2, but every war the US has been involved with since.

First, being "at war" is not good for the economy. Historically, the stock market has always been down during the years in which the US is actively engaged in military conflict. The times of "prosperity" always came after fighting ended and the country went back to business as usual. One of the principal reasons for this upswing in market performance and economic growth after war time is massive government investment in manufacturing and production industries that resulted in significant middle-class job creation. During WW2, for example, government investment in manufacturing was staggering. There was a collective nationalism that had all Americans working for the best interests of the country as a whole out of a sense of patriotism and civic duty. Women were welcomed into the workforce in droves to take up the slack of men who were called away from work to fight overseas. "War bonds" were heavily promoted and invested in, which generated a significant amount of revenue, which the government spent not only on the war effort overseas but in domestic manufacturing and production facilities to help pump out more military equipment and supplies to keep up with demand. Another thing that has to be taken into consideration when discussing the positive economic impact of WW2 and other wars before the 1980's is that there were significant casualties on the American side. While we definitely won WW2, nearly 1.2 million US soldiers lost their life in the conflict. That resulted in a substantial decrease in the American workforce when the war was over. That meant a lot of job vacancies that needed to be filled, along with a lot more that were a result of the growth of the military industrial complex due to massive government investment during the war.

Think about it like this. Right now, about 14 million Americans are out of work, which represents roughly 9% of the total working-age population. Losing 1.2 million working men to war would lower our national unemployment rate by between 1-2% just from hiring people to fill the job vacancies left by those dead soldiers, be they in the private sector or through military recruiting to rebuild our armies. Now, factor in the scope of government investment in manufacturing and production during WW2 and scale that proportionately to our current economy and you would easily lower unemployment by another 2% just by filling in the substantial manufacturing and production needs of supporting a larger military industry. Just like that, our 9% national unemployment rate becomes a statistically acceptable 5% and all we had to do was kill off 1.5 million young men and invest trillions of 2011 dollars into military-based manufacturing and production to do it!

That's the problem with "modern warfare" and the reason why every subsequent war after WW2 has seen smaller and smaller returns on the "investment" until you get to where we are currently, in a massive recession during war. Again, this isn't surprising, the economy is always rocky and prone to poor performance during war time. Remember, our last major recession was just after Operation Desert Storm in 1991. War itself is typically bad for the economy, but the peacetime immediately after war is where the growth and prosperity begins, except when that war doesn't result in massive loss of life in our military or major government investment in private sector manufacturing and production jobs.

In fact, statistically speaking, the fewer the number of US military deaths during war, the smaller the post-war "boom". Likewise, the less money the government spent on building up manufacturing and production industries, the smaller the economic growth. War itself isn't what helps the economy, losing a significant chunk of the job market - that must then be replaced - and a huge infusion of government money into private sector manufacturing and production is what helps the economy. When we have "bloodless" wars and no significant government cash infusion into blue-collar production industries, we have little to no real economic gain by going to war.

Another unpopular reality of war on the economy is that, while the post-war "boom" is typically good for the markets, good for the economy and results in a large upswing in job growth, it also results in a large upswing in inflation as well. Quoting David Hackett Fischer, a professor of History and Economic History at Brandeis,

"The type of inflation that is associated with wars usually arises from increases in aggregate demand. In time of war, government spending for military purposes stimulates demand throughout an economy, at the same time that a shift of workers from productive labor into war production causes a decline in aggregate supply."Essentially, that means that, when the country is at war, domestic government military spending stimulates demand. This results in more job creation as the demand for military equipment and supplies must be met. However, in order to meet that military production demand, many workers are "borrowed" from the private production sector, creating a shortage in private sector manufacturing and the supply of private sector manufactured goods. In other words, using the basic "Guns and Butter" analogy popular in macroeconomics - the more people you put to work making guns, the less people there are to make butter and thus the price of butter goes up as supply has a more difficult time keeping up with demand. As we all know, when demand for a product goes up and supply goes down, costs increase.

The second type of inflation commonly associated with war is due to the declining value of the dollar that arises from rapidly expanding monetary supply and credit. For every major war the US has been in since the Civil War, the people by and large did not want to fund the war effort primarily by increasing their taxes. However, our government still needed the money to pay for the war. So, they simply printed more money and borrowed and issued bonds to raise the funds instead. This flood of cash into the money supply lowers the value of the dollar and causes prices to increase. You can see the results of this right now, in fact. As we continue to fight into the second decade since the "war on terror" was first declared, prices of perishable goods like food have increased by roughly 15-25%. Likewise, gas prices and non-perishable items have also seen sharp price increases since 2001. These prices have increased at a rate much higher than standard inflation, due to the influx of money into the money supply, due primarily to the skyrocketing cost of fighting the wars in Iraq and Afghanistan. While certainly the housing collapse and subsequent bank bailout under Bush and stimulus program under Obama did contribute to our massive deficit and increasing money supply, the primary cause by a large margin is the cost of fighting the war on terror.

The biggest and most significant difference between the effects of past wars on our economy and the current and likely post-war impact of the war on terror on our economy is that, in past wars, there was massive government spending to create manufacturing and production jobs in the private sector to meet with the demand of our military overseas. In this war, there are actually massive layoffs in the private sector instead. Also, a lot of manufacturing is now being done overseas and the level of domestic military spending by our government is far below the historical average as a percentage of total GDP spent in past wars. In short, the reluctance of our government to invest heavily in domestic production, combined with the decreasing human cost of military action means we will see the smallest economic return on the "investment" of war in the history of our republic. In fact, without significant domestic government investment to create manufacturing and production jobs, we might even see a post war recession that far exceeds the one that followed the first Gulf War. It's entirely likely, even, that we might find ourselves in the first real depression since the Great Depression. So, is war good for the economy? Yes and No. It's good after the war is over, but only when the government invests a substantial amount of money into domestic job creation and, unfortunately, it also helps to lose over 100,000 military lives. I'm not a big fan of seeing flag-draped coffins, so that really just leaves the government needing to invest a whole lot more money into our domestic production industries than it has over the last decade. If they don't do this, there is nothing, historically, to indicate this war will be anything but a huge drag on our economy.

Myth 3 - "Class Warfare"

This is sort of a broad topic. "Class warfare" has become a catch-all phrase used to describe any attempt to point out the growing wage disparity between the working class and the wealthy elite. It also is invoked whenever anyone brings up the subject of increasing taxes on the rich or giving tax relief to the middle-class. Simply, "class warfare" is the card that the Republicans play whenever anyone challenges their "coddle the rich" fiscal ideology. So, what do the actual numbers say?

According to the Congressional Budget Office, the income disparity between the bottom 80% of the country and the top 20% is quite significant, as you can see from these charts. Obviously, there is a lot of fluctuation in the income levels of the top 1%, which is due primarily to the fact that most of the income generated by those people is done by "making money with money", or basically through investments, which relies heavily on the stock market, which is prone to wild mood swings, especially during rocky times. Looking at that graph, periods of war, such as Vietnam, Desert Storm and the immediate aftermath of 9/11 and moments of stock market instability such as the crash in the late 80's and the recession of the early 90's, all resulted in wild swings in income for the top 1%. However, even at their "worst" points, financially, the income levels of the wealthiest 1% still floated well above even the top 20% directly below them. Also, as you can see from these graphs, even when income levels dropped substantially, as they did between 2000-2003, it only took about 3 years for that income level to get right back where it was, and another year or so for it to be even higher.

In contrast, the income levels for the bottom 60% look almost like a flat line at the bottom of the first chart. That illustrates the stagnation of middle-class wages over the last 30 years. As the incomes of the wealthiest 20% of the country have seen a marked increase from 1979 to present, wages for the other 80% of the country are almost unchanged as a percentage of GDP. What this means is, even though the productivity of the American worker has risen by nearly 80% since 1979 - essentially American workers are producing 80% more than they did 30 years ago - wages have increased by less than 10% overall. Basically, your dollar has the same buying power today that it did in 1979, even though prices have obviously risen significantly over the last 3 decades.

Now, look at the second graph. That's the change in share of income from 1979-present. Notice how, even after taxes, the share of the total revenue generated in the country that goes to the top 1% is almost identical to the average household income line. That means, basically, that the richest 1%, and to a lesser extent the 20% directly below them, earn a household income that is almost directly proportionate to the amount of revenue generated by the entire national GDP. Now, look at the bottom 80%. Their share of income has declined by anywhere from 10-30%. This means that the middle-class and working poor in this country are getting a smaller and smaller share of the income that is generated from their hard work. In fact, the poorer you are, the worse your share of the pie is relative to how hard you work for it.

What does that mean? It means that middle-class Americans are being underpaid by anywhere from 10-30% over the last 30 years, based on the amount of profits their work generates. That extra money that they aren't being paid is also going directly into the pockets of the richest 20% of the country, and the lion's share of that wealth is going, specifically, to the top 1%. Or, in layman's terms, the more money you make, the more your boss takes.

Now, with all that money that the ultra-rich are making, surely that must directly translate to more job creation, right? Well, I already showed how lowering taxes for the rich has absolutely no positive impact on job creation, but does letting the rich keep more of the profits their workforce helps generate result in more job creation?

Wall St. profits (money generated through growth in the stock market, i.e. corporate profits, investment profits, money made from the strength of businesses - due directly to the productivity of it's middle-class workforce) rose by 720% from 2007-2009. Keep in mind, that period of time covers the stock market collapse and descent of our country into the "Great Recession". In spite of all that market instability and lost wealth, corporate profits still rose by 720%. Considering the continued growth of the market from 2009-2011, it would not be unrealistic to hypothesize that current corporate profits are substantially higher than even that 720% figure.

At the same time, the average pay of a fortune 500 CEO is now 185 times higher than that of his average employee. While large corporations are laying off tens of thousands of working class Americans every year and blaming it on the recession, the unstable economy, Obama or whatever else they think sounds good on the business news channels, the resulting profits earned by cutting their labor force, shipping the jobs overseas and otherwise cutting costs at the expense of the American worker are going directly into their own pockets. A compensation growth of 185 times that of the average worker means that money isn't being spent on job creation, investment, research and development or anything else that would help out the middle-class, the industry as a whole or basically anyone except the CEO himself.

Is it wrong to make profits? Of course not, that's the whole point of starting a business in the first place. If you want to start a business that doesn't make any money, then form a government. However, is it wrong to increase compensation 185 times the middle-class average for your upper management and paying for those exorbitant salaries directly through massive layoffs and net pay decreases for your entire workforce? If I say yes, I'm guilty of "class warfare"...

Let's look at it another way...

This is the effect of "trickle-down" economics over the last 30 years. This chart basically compares the period from 1979-2005 with all the decades prior to 1979 in terms of average income growth for all tax brackets. It looks at how the income was distributed, from the richest 1% all the way down to the bottom 20%, for every decade prior to the introduction of "Reaganomics" or "trickle-down" economics and shows how much more money was made, or lost, by households in each income level and tax bracket based on that change in our nation's fiscal policy.

As you can see, the impact of "trickle-down" economics on the average American worker is significant. Only the top 10% of households have seen an overall wage increase over what they would have received if "Reaganomics" had never been introduced. In contrast, the bottom 90% of the country have all seen an average household income decrease for the same period, due to those economic policies.

What does this mean for you?

Well, if you made less than $65,000 total household income this year, you are in the bottom 90%. According to this chart, if you did make $65,000 last year, you would have made about $70,000 instead if Reaganomics never happened. Incidentally, the less you make, the more you got screwed out of by trickle-down economics. The 41-60% bracket, for example, consists of households that made around $40-55,000 a year. So, if you had a household income of $45,000 last year, you would have made a little over $55,000 if Reaganomics never existed. For families living on a household income of $45,000, think about what an extra $900 a month would mean to you. For most people I know in that income bracket, an extra $900 a month would mean being able to finally replace that gas-guzzling junker with a new car, or it would mean being able to buy a house instead of renting, or it would mean being able to get braces for the kids and put some money away to send them to a good college. There is a lot that a middle-class family can do with an extra $900 a month, but you're not getting it because of trickle-down economics. Don't worry though, according to the supporters of this pyramid scheme thinly disguised as a viable economic policy, trickle-down economics means more jobs, better wages and prosperity for everyone! Maybe you can use that instead of money when you go to make a down-payment on a new car, buy a home or just cash it like a check to supplement your unemployment benefits because you got laid off so a CEO could meet his quarterly profit goals and get a nice, fat bonus. Careful... pointing out the obscene victimization of the middle-class by the ultra-rich is "class warfare!"

But wait... there's more!

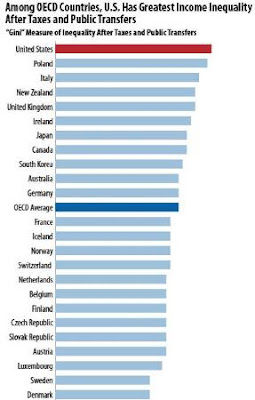

According to the ranking of OECD (Organization for Economic Cooperation and Development) countries based on income disparity, the United States ranks worst out of all participating nations. This means, basically, that America has the worst income disparity of any "first-world" country. According to recently-revised CIA rankings, the United States ranks 39th among the countries with the worst income disparity in the world, and is the absolutely lowest-ranking country that isn't ruled by an autocratic dictatorship, a "banana republic", a totalitarian regime or a deeply-flawed hybrid "democracy", such as an outright plutocracy, oligarchy or theocratic society, such as those in the middle east and South America.

This, in a nutshell, is trickle-down economics and unregulated capitalism at work. This is the result of a fiscal policy that "coddles the rich" with increasingly lower taxes, less regulation on how they conduct business, no government influence over job creation or investment and a laissez faire attitude towards massive layoffs and shipping entire industries overseas in the pursuit of profit above all else.

Down at the "bottom" of that list - which would actually be the countries with the least income disparity between the ultra-rich and the poor - the countries with the best rankings are those "socialist" European countries like Denmark, Sweden, Austria, the Czec Republic... Incidentally, the two countries with the lowest income disparity - Denmark and Sweden - are ranked at the top of the lists of quality of life as reported by the residents of those countries. They also lead the world in education and have some of the lowest crime rates, teen drug abuse and pregnancy rates and, in spite of the fact that these countries both allow same-sex marriage and legally-recognized same-sex co-habitation, they have some of the lowest divorce and single-parent household rates in the world as well.

So, is "class warfare" a myth? No. It is true. However, the "warfare" is not being carried out by the poor and the working class against the rich. Rather, according to all possible available data, the "warfare" is actually being carried out by the rich against the poor. The United States leads the entire industrialized "first world" in income disparity. The gap between the richest and the poorest in America is only bested by countries like Haiti, Colombia, Zimbabwe and Sri Lanka. The United States is the lowest-ranking country in the world for income disparity with a "democratic" government, which makes our situation even more pathetic, because - unlike nearly every other country with a worse income disparity than America - we actually voted for the people and policies that put us in this mess.

I can already tell I'm going to re-visit the topic of "myth busting" a lot. This is just the tip of the iceberg when it comes to setting straight the mis-information and outright distortions of the truth by conservatives who want to maintain the pro-rich status quo and who have bamboozled millions of hard-working, middle-class Americans into adamantly supporting the very policies and politicians who are directly responsible for them making significantly less money for statistically more work output than ever before in the post-industrial history of our country. For now though, you can confidently and accurately argue with anyone who tries to use any of those 3 popular conservative talking points on you to try and justify why they continue to vote Republican, in spite of the fact that they aren't millionaires.

For everyone I know who is a millionaire, by all means, keep voting Republican. I mean, I would too if I were you. It actually makes sense for people to vote in their own best interests, so I don't blame you one bit for supporting the party that unquestionably supports you and only you. However, if you aren't a millionaire... if you aren't even a half-millionaire... and you consistently vote Republican... I really have to ask, simply, why? Do you somehow think you're going to be a millionaire if you keep voting Republican? Because I got a chart that proves you only have a 1 in 22 chance of ever reaching a 1 million dollar net worth if you have a current household income of no less than $120,000 - which most middle-class Republican voters do not have. The average middle-class income is $50,000 a year, less than half the median necessary to even have a 1 in 22 chance of being worth just one million dollars in your lifetime. For people making $50,000 a year or less, that likelihood plummets exponentially. Your odds of becoming a millionaire if you make less than $50,000 a year are about the same as being struck by lightning. So, how is it at all in your best interests, as a middle-class Republican voter, to continue supporting the people and policies that have caused you to currently earn anywhere from $5-10,000 a year less than you should be making and be able to buy less with the money you actually do make?

Don't worry, you'll have plenty of time to think of some good answers as I continue to debunk the myths of your party's platform.

No comments:

Post a Comment